The Australian government released a consultation paper on 12 December 2022 seeking opinions for designing and executing a binding climate-related fiscal reporting rule in the country.

The step is being looked at as significant because it comes close on the heels of a pledge made by the government in its October budget to introduce standardised and globally-aligned climate disclosure requirements.

Decoding the plan

Not long ago, the country’s fiscal supervisory bodies suggested that establishments make climate-related fiscal risk disclosures following the structure set up by the Task Force on Climate-related Financial Disclosures (TCFD). Currently, around half of the ASX-200 are voluntarily reporting under this structure, witnessing a steady increase in the number on a year-on-year basis.

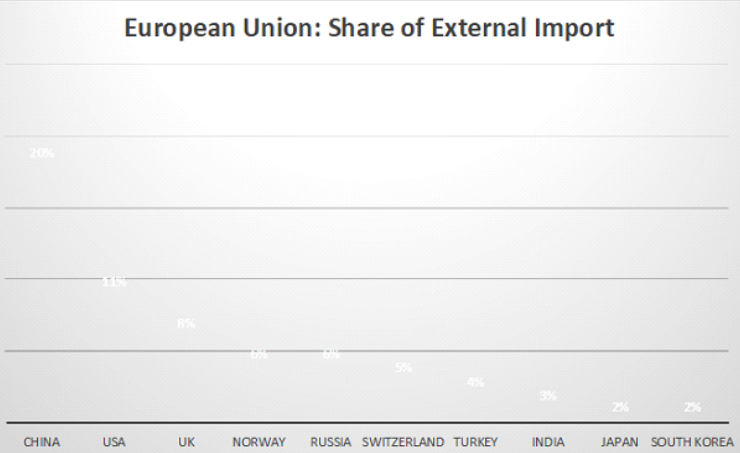

With this plan, the government endeavours to address the needs of the investors demanding improved quality and internationally-comparable climate disclosures as the US, the UK and the EU have either introduced or developed mandatory reporting requirements for companies.

The plan revolves around exploring such crucial questions as the cost and benefit of implementing such a framework, its usage by large establishments in a phased manner, in addition to it being thoroughly in line with the emerging suggestions made by the International Sustainability Standards Board (ISSB), the disclosure of transition plans and the data related challenges encountered in meeting the new requirements.

Under its ambit, the plan calls for deliberations that could later get applied to greenhouse gas emissions reporting. It specifically focuses on Scope 3 emissions, entailing upstream and downstream emissions outside of a company’s direct control. They are the toughest to track and quantify because they involve the supply chain or a company’s product usage emissions. Due to this reason, they find favour with emerging disclosure regimes, including ISSBs, the EU and the projected US SEC rules.

The Treasury Department has been additionally tasked to devise an all-inclusive sustainable finance strategy. Climate risk disclosure will form a part of the strategy, intending to enhance transparency and develop green finance markets.

17 February 2023 is the deadline, marking the end of the consultations.

Bibliography

1. Image Source- IFLR, 2022. Article. [Online] Available at: https://www.iflr.com/article/2a89z2hbokzmh6iagcidc/corporate/primer-sec-climate-related-disclosures-for-investors