Gender Lens Investing (GLI) is a relatively new form of impact investing, gaining more interest in recent times from within asset management firms and the financial media alike. The core values behind GLI are without question the right move and should be encouraged and implemented in different forms all round. But what does it mean to invest with a gender lens, and how does this provide investors with financial gains?

The Gender Lens Investing market now equates to $2.4 billion into 35 GLI vehicles through publicly traded securities. This figure was $100 million just four years ago. [1] Investors use capital to deliver financial returns while improving the lives of women and girls in their community. The focus is increasing around the world on these outcomes as part of the UN’s Sustainable Development Goal #5: Gender equality, aiming to end all forms of discrimination against women and girls and accelerate sustainable development.

-

Studies have shown that greater gender diversity in senior management positions can be used as a predictor of long-term value creation and lead to lower return volatility[2].

-

According to a McKinsey study, in a “full potential” scenario in which women play an identical role in labour markets to that of men, as much as $28 trillion, or 26 percent, could be added to global annual GDP by 2025[3].

-

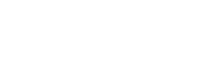

The global female economy control about $20 trillion in annual consumer spending, and that figure could climb as high as $28 trillion in the next five years. The $13 trillion in total yearly earnings could reach $18 trillion in the same period. In aggregate, women represent a growth market bigger than China and India combined[4].

“There is growing evidence and collective understanding that gender equity is good for investment, good for businesses, good for society. However, this understanding has not translated into widespread action in the investment world,” a new report by Calvert Impact Capital states, looking at the connection between gender and financial performance stated.[5]

As more investors adopt GLI strategies, it is likely investors will be provided with greater insight into which metrics to track and greater definition around what constitutes investor best practices. As Jackie VanderBrug, senior vice president at U.S. Trust, said;

“This is a lens and not a limitation. A gender lens helps you see opportunity and mitigate risk.”[6]

As the number of GLI vehicles increase, investors have begun making the leap from investing in single products to constructing entire, fully diversified GLI portfolios with clear missions. Examples of these missions may include gender-based violence, gender equality, women’s chronic under-representation in leadership, backing businesses that benefit women through products & services, and the need for innovation in women’s health care.

GLI is part of the sustainable investing boom, including ESG, SASB and SRI reporting. Investors now consider ESG factors for USD $12 trillion of professionally managed assets, according to the latest report by the US Forum for Sustainable and Responsible Investment (US SIF)[7]. Firms worldwide have understood the increasing attention on ESG reporting from stakeholders, which have responded through undertaking internal initiatives to improve performance on ESG issues.

With the accelerating flow of capital into the public market, GLI products will be of keen eye among investors. Gender-smart capital is one of the largest movements of wealth, and will represent a significant pool in the investment markets. This will drive systemic change and create a more inclusive investment ecosystem.

Written by ESG Responsible Investments (www.esgri.com) and noted sources

[1] https://www.veriswp.com/gender-lens-investing-2018-is-a-watershed-moment/

[2] http://english.ckgsb.edu.cn/sites/default/files/files/Board%20Diversity_20160201.pdf

[3] https://www.mckinsey.com/featured-insights/employment-and-growth/how-advancing-womens-equality-can-add-12-trillion-to-global-growth

[4] https://hbr.org/2009/09/the-female-economy

[5] https://www.calvertimpactcapital.org/storage/documents/calvert-impact-capital-gender-report.pdf

[6] https://www.nytimes.com/2015/08/15/your-money/with-an-eye-to-impact-investing-through-a-gender-lens.html?_r=0

[7] https://www.ussif.org/blog_home.asp?display=118 (Complete report is not available to the public without purchase)

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.