With over $130 billion in Green bonds expected to be issued in 2017 alone, ESG reporting has become an essential investment tool for issuers and investors alike.

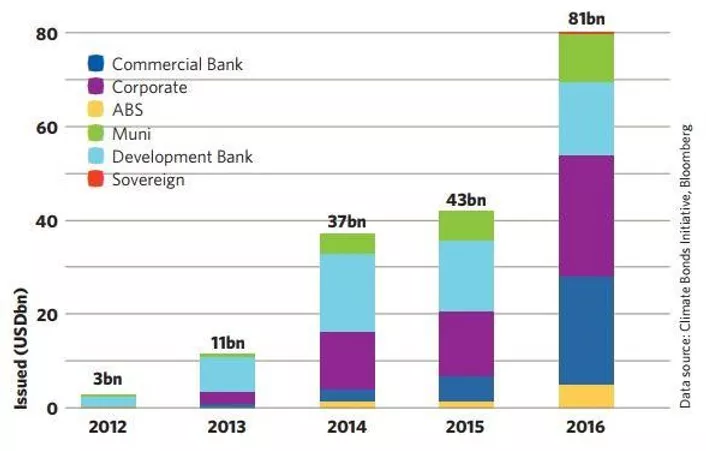

The significant growth in ESG investing has been supported by the development of quantitative ESG investment tools, greater data accessibility, and improved disclosure standards across both national and international markets.[1] ESG factors provide the substantive, regulatory framework for investors and issuers to ensure green bonds, both minimise investment risk and provide adequate environmental benefit. Green bonds are simple fundraising instrument with one key advantage, the deliverance of positive and verifiable environmental impacts which can serve to attract a diverse range of new potential investors. With over $80 billion (USD) in green bond issuances and $8.2 trillion assets tied to ESG strategies in 2016 alone, understanding ESG performance frameworks has become an essential component of investor’s fiduciary duty (Figure 1.1).[2]

Currently, green bonds are primarily issued under two voluntary ESG frameworks, the Green Bond Principles and Climate Bond Initiatives…

Green Bond Principles (GBP) are comprised of voluntary process guidelines that provide issuers with guidance on key components involved in launching a credible green bond. GBP suggest the issuer:

• Define processes for evaluation and selection of the green project.

• Have systems to trace the green bond proceeds.

• Report, at least annually, on the use of the proceeds.

Climate Bond Initiatives (CBI) Climate Bond Standard provides issuers the opportunity to get their green bonds certified. Third parties are required to verify that the bond complies with the Climate Bond Standard (CBS) before CBI issues the certificate. Thus, ensuring the credibility of the issued bond among investors.

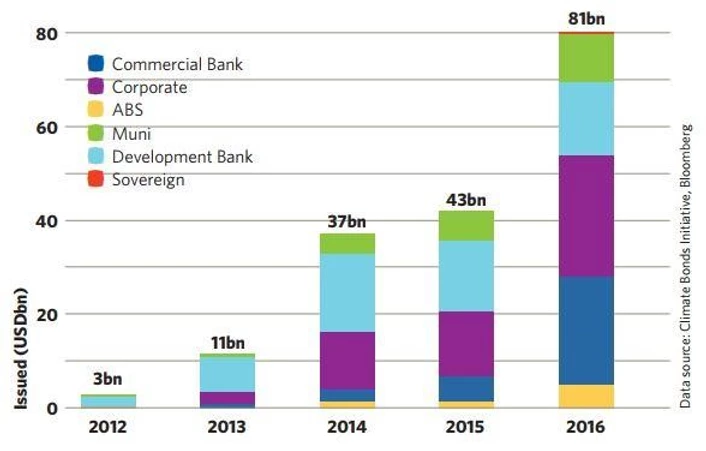

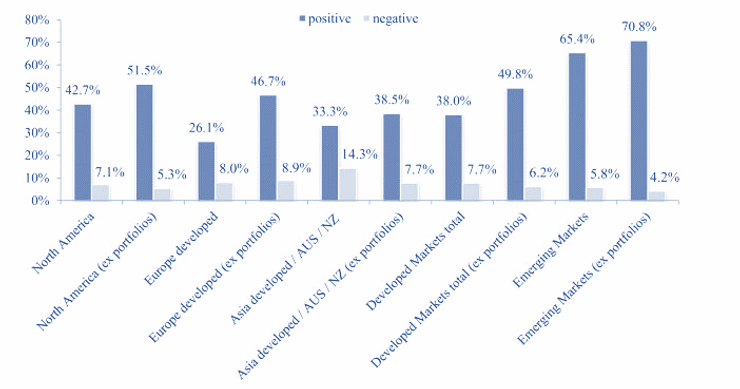

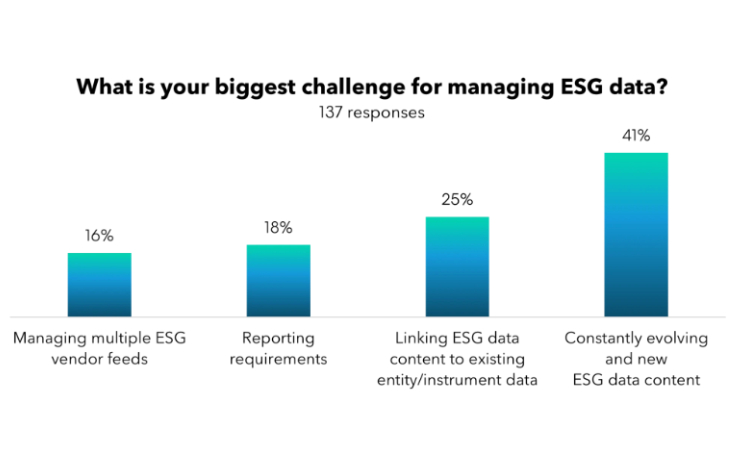

The heightened demand for ESG reporting has been driven by the positive financial performance of companies across a diverse range of market environments, which perform well with regard to ESG metrics (Figure 1.2).[4] In a recent CFA Institute study, almost 75 percent of investors surveyed said they considered ESG issues during the investment process.[5] Despite these trends, the current green bond guidelines do not mandate the obvious synergies afforded by ESG reporting, such as performance disclosure or compliance monitoring. Without this incorporation, investors’ ability to accurately gauge bonds financial and environmental performance is hindered.[6]

Implementing an efficient and standardised ESG regulatory framework could alleviate any investor uncertainty and provide greater transparency for green bond issuers and investors alike. This standardisation could serve to match the shift of mainstream investors towards responsible investing, allowing investors to effectively assess risk and environmental benefits over the life cycle of a green bond.[8] With of over 40% of green bonds issued in 2015 undergoing continued audited assurance and ESG reporting measures; the importance of establishing ESG reporting frameworks in attracting and retaining new investors is already being acknowledged throughout the market.[9] Issuers and investors can also enhance their broader reputation and establish credibility in a burgeoning market, as green finance continues to increase its market share. The integration of social and governance factors can provide investors with a more comprehensive and previously undisclosed overview of a green bond’s material risk, whilst a rigorous scientific framework ensures the bond satisfies its green criteria for perpetuity.

Implementing ESG frameworks can therefore mitigate uncertainty for investors, facilitating the growth of the green bond market.[10] Many institutions and markets have lagged behind in integrating objective ESG standards into their financial reporting, ultimately to their detriment. The recent Commonwealth Bank lawsuit regarding ‘inadequate disclosure of climate change risks’ provides yet another pertinent example of the potential consequences for failing to address investors growing demand for improved ESG reporting.[11] With investors considering and evaluating companies’ ESG performance regardless of their disclosure standards, ESG inaction is already impacting and potentially restricting access to capital. Given these impacts, the integration and implementation of ESG reporting measures should ultimately be seen as essential to navigating the emerging green bonds market.

References

Climate Bonds Initiative. (2017). ‘The role of exchanges in accelerating the growth of the green bond market’ retrieved from https://www.climatebonds.net/files/files/RoleStock%20Exchanges.pdf

European Commission (Green Finance & Economic Analysis unit). (2016). ‘Study on the potential of green bond finance for resource-efficient investments’ retrieved from http://ec.europa.eu/environment/enveco/pdf/potential-green-bond.pdf

EY. (2016). ‘Green bonds: a fresh look at financing green projects’ retrieved from http://www.ey.com/Publication/vwLUAssets/Green_bonds-a-fresh-look-at-financing-green-projects/$FILE/EY-Green%20bonds-a-fresh-look-at-financing-green-projects.pdf

Floods, Chris. “Green Bonds Need Global Standards.” Financial Times 2017: 1. Web. 15 Aug. 2017.

Goldman sachs. (2016). ‘Environmental, social and governance report 2016’ retrieved from http://www.goldmansachs.com/s/esg-report/

Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233

Khalamayzer, Anya. “The Race To Embrace ESG Ratings.” GreenBiz. N.p., 2017. Web. 17 Aug. 2017.

VanEck. (2017). ‘What Led to the Demand Growth for Green Bonds?’ retrieved from http://marketrealist.com/2017/05/led-demand-growth-grnb/

[1] Goldman sachs. (2016). ‘Environmental, social and governance report 2016’ retrieved from http://www.goldmansachs.com/s/esg-report/

[2] VanEck (2017) ‘What Led to the Demand Growth for Green Bonds?’ retrieved from http://marketrealist.com/2017/05/led-demand-growth-grnb/

[3] Climate Bonds Initiative. (2017). ‘The role of exchanges in accelerating the growth of the green bond market’ retrieved from https://www.climatebonds.net/files/files/RoleStock%20Exchanges.pdf

[4] Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233

[5]Khalamayzer, Anya. “The Race To Embrace ESG Ratings.” GreenBiz. N.p., 2017. Web. 17 Aug. 2017.

[6] Floods, Chris. “Green Bonds Need Global Standards.” Financial Times 2017: 1. Web. 15 Aug. 2017.

[7] Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, 210-233

[8] EY. (2016). ‘Green bonds: a fresh look at financing green projects’ retrieved from http://www.ey.com/Publication/vwLUAssets/Green_bonds-a-fresh-look-at-financing-green-projects%20$FILE/EY-Green%20bonds-a-fresh-look-at-financing-green-projects.pdf

[9] European Commission (Green Finance & Economic Analysis unit). (2016). ‘Study on the potential of green bond finance for resource-efficient investments’ retrieved from http://ec.europa.eu/environment/enveco/pdf/potential-green-bond.pdf

[10] Floods, Chris. “Green Bonds Need Global Standards.” Financial Times 2017: 1. Web. 15 Aug. 2017.

[11] Climate Bonds Initiative. (2017). ‘The role of exchanges in accelerating the growth of the green bond market’ retrieved from https://www.climatebonds.net/files/files/RoleStock%20Exchanges.pdf

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.