It’s a trend seen globally: investors are looking beyond financial statements for a more complete picture of how companies create long-term value. Although businesses have begun to address material sustainability factors in their corporate reporting (over 80 percent of the world’s top economies by GDP in 2016 mandated ESG reporting in some form), the quality of these disclosures is lacking. The challenge lies in understanding which ESG framework is appropriate to use, and what investors truly are looking for from an ESG risk exposure perspective.

The below chart from the UN Principles of Responsible Investment (UN PRI), shows the rapid growth of ESG related policies being introduced globally.

Considering the vast number of investment manager UN PRI signatories, each with teams of ESG analysts globally, it’s no wonder many developed markets integrate ESG reporting within their corporate reporting strategy.

However, the quality of these disclosures is often lacking, with many reports focused on meeting compliance requirements.

Reporting on ESG performance is much more than a compliance exercise. When done effectively, these reports are a key communication tool to engage shareholders and investors. They reflect the company’s recognition of its responsibilities as a corporate citizen, benchmark its performance against peers, and demonstrate a commitment to increasing transparency and accountability.

A strategic approach to ESG embeds these values across company strategies, policies, communications and stakeholder engagement processes, and drives continual improvement in business practices to mitigate risks associated with ESG impacts.

ESG strategy and implementation shouldn’t only be considered as risk mitigation. An effective and engaged strategy will drive a range of stakeholder outcomes

-

Communication: Improved messaging, transparency & engagement with both internal and external stakeholders.

-

Expanded Investor Base: Access to long-term responsible investors.

-

Current Investors: Assurance of management involvement & strategic vision.

-

Brand: Increased control and perception of brand image to suppliers, clients, customers, employees for retention and acquisition.

-

Financial & non-financial performance: Improved non-financial management translated to financial improvement.

-

Risk Mitigation: Adept risk identification, control & opportunity to innovate.

While there are many different ESG reporting frameworks (GRESB, GRI GSSB, CDP, SASB, IIRC) and it is easy to get confused, applying an ESG framework doesn’t need to be a complex process. Essentially it starts with understanding what investors are looking for from an ESG risk exposure perspective, and the strategic approach adopted by the company to address risks.

Investor Relations (IR) holds a key role in holding this focus. IR must collaborate with stakeholders across the company to ensure its approach to ESG strategy and reporting integrates investor demands, and is targeted to both internal and external stakeholder needs.

Heads of IR specifically need to:

- Understand the ESG disclosure and reporting environment in which the company operates.

- Address ESG-related disclosures and communications, identifying responsible investors to engage.

- Audit current ESG performance and benchmark the company’s level of ESG disclosures against peers’.

- Identify and implement strategies to improve ESG performance.

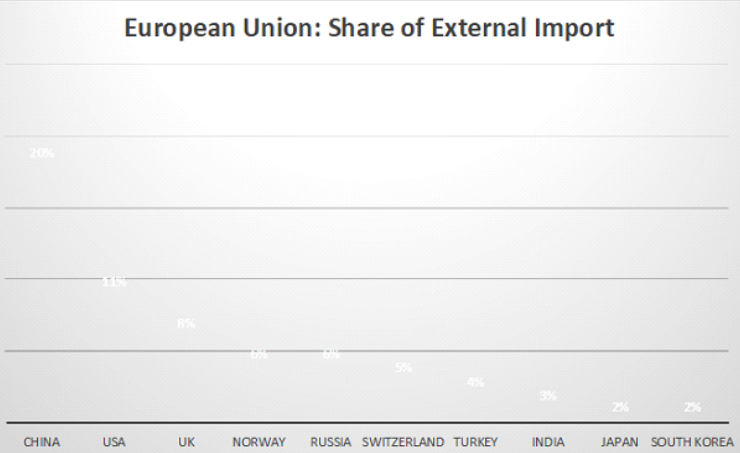

The key objectives are to create positive social impact and business value, whilst ensuring shareholders needs are addressed. ESG application in the Australian market has been slow and undynamic in comparison to Europe, USA, and markets in Asia such as Japan and South Korea.

ESG reporting should be externally assured to provide investors with additional confidence in the report findings.

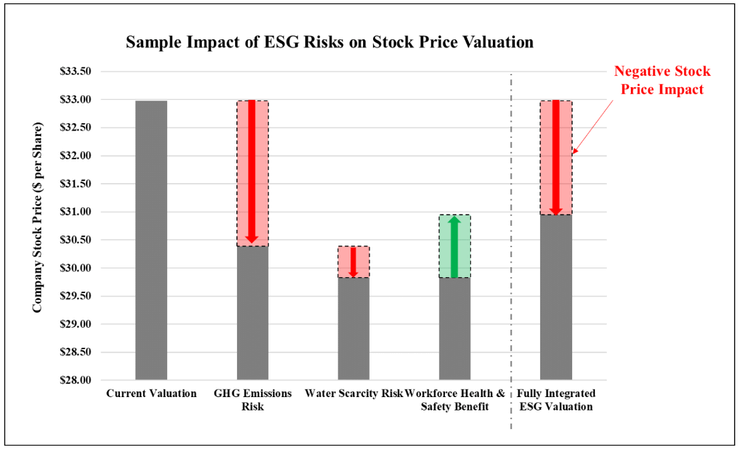

The below diagram, from Sustainable Accounting Standards Board (SASB) materiality assessment, depicts how ESG risk assessments are used in calculating share price performance. It clearly illustrates the impact of ESG risks and the importance of a strategic, integrated approach.

When choosing the best fit ESG strategy, IR managers may benefit from looking at the European leaders in this space. One highlight recently mentioned to a colleague at the COP23 summit, was Finish telecommunications business Elisa. One look at the table of contents for their Annual Report shows how integrated ESG is in all their operations. This has fostered an industry leading approach with innovation at the forefront. There are clear and transparent communications throughout the report, describing the risk, outlining the impact assessment, and disclosing the strategy to address this.

Considering these challenges, IR should be actively engaged and integrated and leading organisational sustainability & ESG planning. Companies will be better able to understand and respond to the interest that both mainstream and responsible investors are showing with respect to ESG risks and disclosure. ESG is a material risk to any organisation, and should be treated similarly to corporate and annual reporting.

By James Cronan – ESGI James.C@esgri.com

Contact us to discuss how your organisation can reduce ESG risks, create an effective ESG strategy, reduce their carbon footprint and better manage ESG risk in your supply chain.