ESG for small business – a risk or an opportunity post Covid-19

ESG issues ESG issues are becoming increasingly prevalent for businesses large and small as the world shifts to the 4th industrial revolution. In recent times the expectations of businesses to integrate ESG (Environmental, Social and Governance) risk management into...

Better pricing on FX forwards using ESG & sustainable finance target

A growing number of corporate treasurers are exploring how their foreign exchange hedging positions can help make them a cleaner and more responsible organisation. Global Banks such as Deutsche Bank, BNP Paribas & JP Morgan are creating derivative instruments...

Shareholder ESG Class Actions Increase – When climate change became a financial issue

The shift from ethical issues to financial issues: climate change isn’t just a moral issue anymore; it’s also a financial one. BHP Billiton is currently facing three class-action lawsuits relating to damages from Brazil’s worst environmental disaster, the collapse of...

Australia’s first CBI ‘Green Loan’ for A$170M closed

Investa commercial Property Fund (ICPF) has just closed Australia’s Climate Bonds Initiative (CBI) compliant Green Loan for A$170m. This was achieved by matching Investa’s portfolio of planned commercial buildings against the CBI emissions thresholds, requiring assets...

Issue a Green Bond to Buy a Green Bond

Is issuing a green bond to the capital market and buying a green bond incorporated by corporations in developing nations, development banks new strategy? If this trend is accurate, the strategy is encouraging for all corporations across the globe and emerging market...

Gender Lens Investing – Keeps getting stronger and stronger

Gender Lens Investing (GLI) is a relatively new form of impact investing, gaining more interest in recent times from within asset management firms and the financial media alike. The core values behind GLI are without question the right move and should be encouraged...

Green Trees, Green Money, Green Buildings

Buildings with ‘Green’ credentials are financially a better investment (and have been so for some time). Global Brands want to lease them, Real Estate Funds want to own them, and the Bond Market wants to fund them. Tenants, investors and lenders are further realising...

“Big Oil” + Corp. Bonuses = Sustainability?

With about half of G20 members falling short of achieving their domestic targets set out in the Paris Agreement[1], major energy and resource corporations are under pressure to rapidly alter their carbon emission performance. Royal Dutch Shell has recently announced...

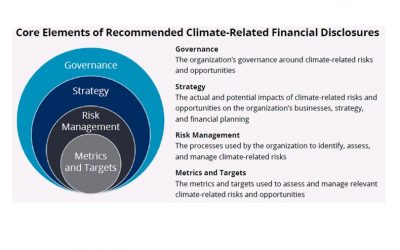

ESG Reporting and ESG Corporate Integration, there is a difference.

It has been reported most companies in the S&P 500 meet the regulatory reporting requirements for Environmental, Social & Governance (ESG) Reporting each year. However, despite the investor community and comparable ETF’s indicting positive results towards...