by ESGRI Admin | May 20, 2022 | ESG

Australia, has your purchase fueled slavery? After years of deliberation the Australian Modern Slavery bill was recently passed in Parliament to come in effect from January 1st. Large businesses with a consolidated revenue in excess of AUD$100m will be required to...

by ESGRI Admin | May 20, 2022 | ESG

Aussie Banks sign up to the latest SDG UN-endorsed programme A series of global banks signed up to the latest United Nations-endorsed financial programme, designed to align the financial services sector with the UN’s Sustainable Development Goals and the Paris Climate...

by ESGRI Admin | May 20, 2022 | ESG

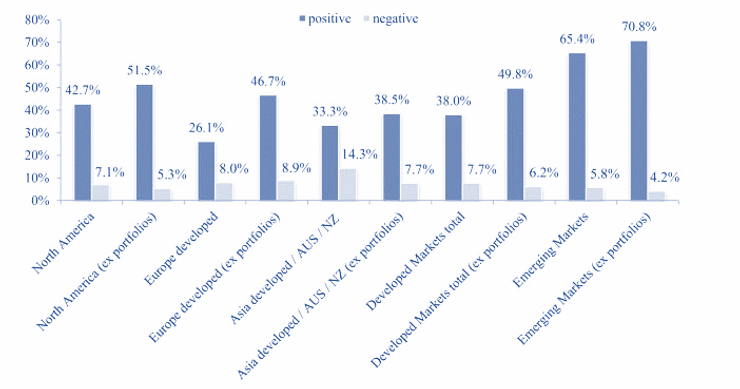

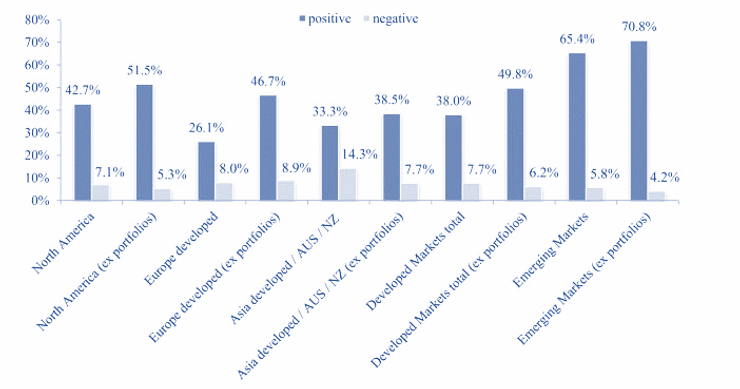

Environmental, Social & Governance applied to corporates against commercial credit risks Over the past five years discussion around the role of Environmental, Social and Governance (ESG) in credit risk has become a sticking point with qualitative considerations...

by ESGRI Admin | May 20, 2022 | ESG

The importance of environment, social and governance (ESG) factors to current investment trends When did ethical and sustainable investment strategy become a serious consideration for shareholders, investors and asset managers? Global investment focus of shareholders,...

by ESGRI Admin | May 20, 2022 | ESG

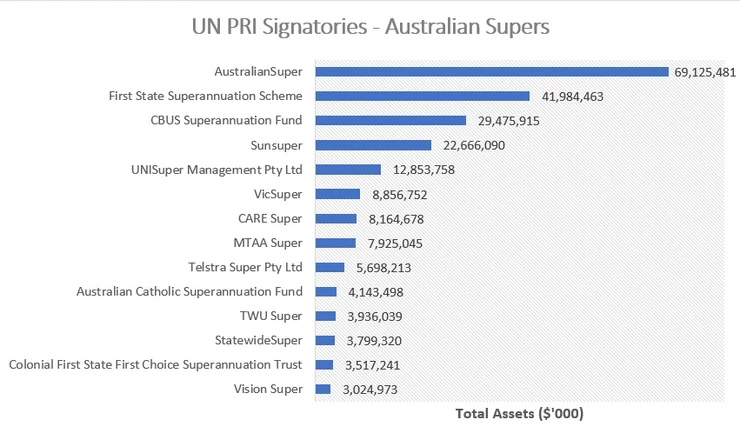

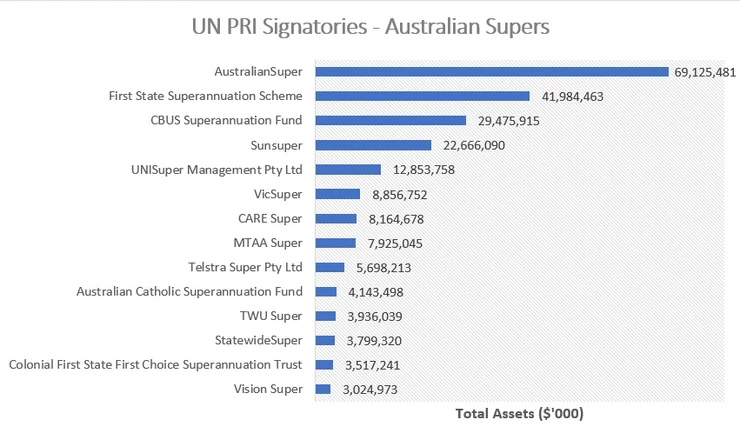

Growing momentum of ESG Investments in Australia Main Takeaways: ESG offers institutional investors such as super funds and global fund managers a product differentiator to take to market. Several of the largest super funds in Australia are UN PRI signatories,...

by ESGRI Admin | May 20, 2022 | ESG

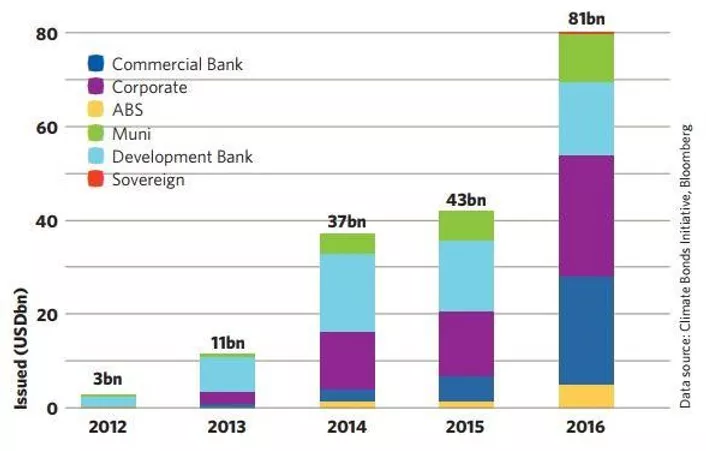

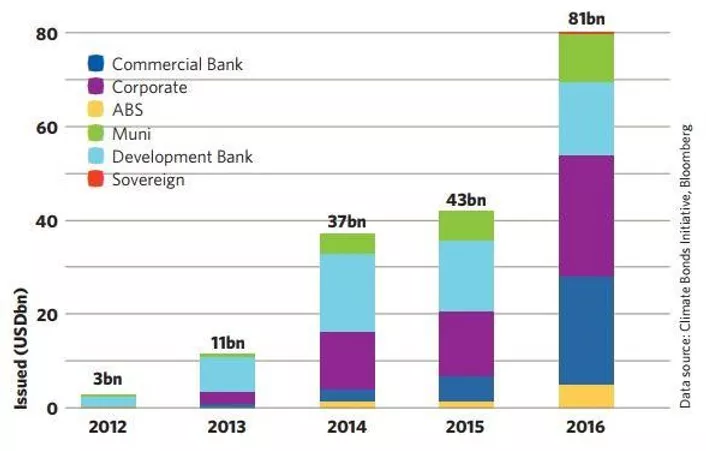

Green Bonds and ESG: Emerging Synergies With over $130 billion in Green bonds expected to be issued in 2017 alone, ESG reporting has become an essential investment tool for issuers and investors alike. The significant growth in ESG investing has been supported by the...