Australia, has your purchase fueled slavery?

After years of deliberation the Australian Modern Slavery bill was recently passed in Parliament to come in effect from January 1st. Large businesses with a consolidated revenue in excess of AUD$100m will be required to annually report on the risks of modern slavery...

Aussie Banks sign up to the latest SDG UN-endorsed programme

A series of global banks signed up to the latest United Nations-endorsed financial programme, designed to align the financial services sector with the UN’s Sustainable Development Goals and the Paris Climate Agreement. Combined, the bank signatories represent in...

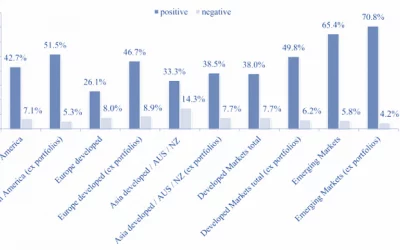

Environmental, Social & Governance applied to corporates against commercial credit risks

Over the past five years discussion around the role of Environmental, Social and Governance (ESG) in credit risk has become a sticking point with qualitative considerations and forecasts becoming material in risk analysis. A report by Macquarie Group has shown that...

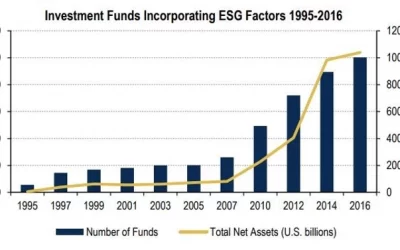

The importance of environment, social and governance (ESG) factors to current investment trends

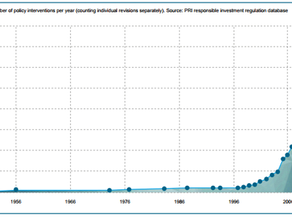

When did ethical and sustainable investment strategy become a serious consideration for shareholders, investors and asset managers? Global investment focus of shareholders, investors, and investment managers is shifting. We are currently seeing the transfer of wealth...

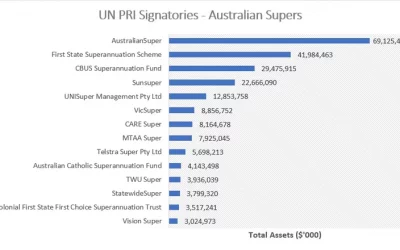

Growing momentum of ESG Investments in Australia

Main Takeaways: ESG offers institutional investors such as super funds and global fund managers a product differentiator to take to market. Several of the largest super funds in Australia are UN PRI signatories, agreeing to make investments with ESG in mind. One of...

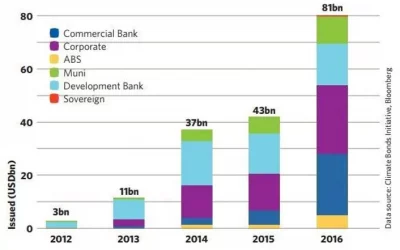

Green Bonds and ESG: Emerging Synergies

With over $130 billion in Green bonds expected to be issued in 2017 alone, ESG reporting has become an essential investment tool for issuers and investors alike. The significant growth in ESG investing has been supported by the development of quantitative ESG...

ESG, Investment Managers, and the Australian abnormality

I landed yesterday from a week in NYC meeting a range of fund & asset managers, environmental social & governance (ESG) reporting houses, and investment banks (thank you all for making the time to meet!). What an interesting week, especially coming from the...

Sustainable Future Group at COP23

A month ago I had the pleasure of attending COP23 conference in Bonn, Germany. COP23 is the twenty third annual UN Conference on Climate Change a meeting of governments and politicians on action to address climate change. This year’s conference was about the detail:...

WHY ESG responsibilities sit with Investor Relations

It’s a trend seen globally: investors are looking beyond financial statements for a more complete picture of how companies create long-term value. Although businesses have begun to address material sustainability factors in their corporate reporting (over 80 percent...